Picture this: I’m at a family barbecue, trying to explain Bitcoin to my skeptical uncle, and I blurt out, “It’s like gold, but digital!” He squints, I stammer, and my cousin saves me with a chicken wing distraction. Sound familiar? If you’ve ever struggled to pin down why Bitcoin’s got everyone buzzing, you’re in for a treat.

Analysts are spotting eerie similarities between Bitcoin and gold (XAU), predicting a jaw-dropping climb to $155,000. Better yet, they’re calling Bitcoin a hedge against everything from global economic rollercoasters to your portfolio’s bad days. So, pull up a chair, grab a coffee, and let’s dive into why Bitcoin’s stealing gold’s shine—and how it’s your wallet’s new wingman. Let’s go!

Table of Contents

- Key Takeaways

- Why Bitcoin’s Twinning with Gold

- Bitcoin’s $155,000 Price Prediction

- Bitcoin as a Hedge: Gold’s Cool Cousin

- FAQs

Key Takeaways

- Bitcoin mirrors gold’s price moves, earning its “digital gold” badge with limited supply and safe-haven swagger.

- Analysts predict Bitcoin could hit $155,000, driven by wedge breakouts, ETF demand, and global liquidity surges.

- As a macro hedge, Bitcoin shields against inflation, trade wars, and currency woes, much like gold.

- In micro environments, Bitcoin diversifies portfolios, holding firm during tech crashes or crypto market dips.

- Technical charts—cup-and-handle for Bitcoin, head-and-shoulders for gold—signal bullish vibes for both.

Ever tried explaining Bitcoin to your grandma and ended up comparing it to gold bars? Yeah, me too. Last Thanksgiving, I thought I’d dazzle my family with my crypto knowledge, tossing around “blockchain” like a pro. Spoiler: I fumbled, blushed, and mumbled something about “digital gold.” But here’s the thing—analysts are shouting from the rooftops that Bitcoin really is twinning with gold (XAU), predicting a wild ride to $155,000. Plus, they say Bitcoin is a hedge against everything from global chaos to your neighbor’s bad stock picks. So, grab your coffee, and let’s unpack why Bitcoin’s stealing gold’s spotlight—and how it’s your portfolio’s new best friend.

Why Bitcoin’s Twinning with Gold

The “Digital Gold” Nickname

Bitcoin didn’t just wake up one day and decide to cosplay as gold. The nickname “digital gold” stuck because they share some serious DNA. Both have a limited supply—gold’s stuck in the Earth’s crust, while Bitcoin’s capped at 21 million coins, thanks to its code. Both dodge central bank meddling, unlike fiat cash that gets printed like confetti. And let’s be real: when the economy’s wobbling, people clutch Bitcoin or gold like life rafts.

Advertisement

Join Gemini today and get $15 in free Bitcoin when you trade with an easy, secure and U.S.-regulated crypto exchange you can trust. Offer valid for U.S. residents only; crypto investments are risky.

Back in 2020, when stimulus checks flooded wallets and the Fed’s balance sheet ballooned, gold hit record highs, and Bitcoin zoomed to $11,000. Analysts like Giles Coghlan at HYCM called it a “perfect” setup for scarce assets. Fast forward to 2025, and Bitcoin’s still riding that wave, with gold prices climbing to $3,200 per ounce as trade wars loom. The vibe? Investors love assets that don’t bow to inflation or geopolitical drama.

Price Patterns: Déjà Vu Vibes

Now, here’s where it gets spooky. Bitcoin’s price chart is pulling a doppelgänger act with gold’s. X user @intelreactor dropped a gem in April 2025, pointing out how both assets pulled “bear traps” early this year. Bitcoin dipped below $73,000, gold under $2,700—suckering short-sellers before rocketing to $97,000 and $3,179, respectively. It’s like they’re in cahoots, dodging the same traps.

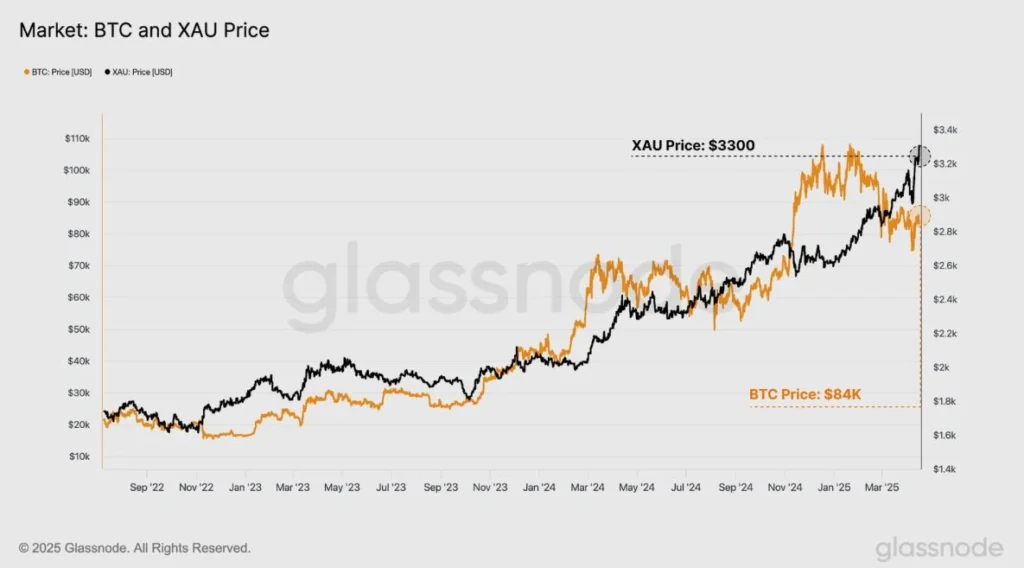

Analysts also spot similar technical patterns. Bitcoin’s forming a wedge breakout, mirroring gold’s bullish runs during past uncertainty spikes, like the 2020 pandemic. Cointelegraph reports on-chain data from Glassnode showing Bitcoin’s momentum echoing gold’s when it smashed records. The takeaway? When gold zigs, Bitcoin often zags in the same direction, just with more crypto swagger.

Bitcoin’s $155,000 Price Prediction

Analysts’ Crystal Ball

So, why are analysts betting on Bitcoin hitting $155,000? It’s not just wishful thinking. Crypto analyst Cryptollica, quoted on X, sees Bitcoin following gold’s playbook. With gold at all-time highs above $3,300, Bitcoin’s wedge breakout signals a potential moonshot. Bitwise CIO Matt Hougan takes it further, predicting Bitcoin could hit $1 million in four years if it snags gold’s market cap. That’s bold, but even a slice of that pie could push Bitcoin to $155,000.

Why the hype? Bitcoin’s proving it’s not just a speculative toy. Spot Bitcoin ETFs launched in 2024 pulled in retail cash, boosting demand. Plus, global M2 money supply hitting $90.21 trillion fuels both Bitcoin and gold, as liquidity loves scarce assets. It’s like pouring rocket fuel on a campfire.

Chart Signals and Breakouts

Let’s nerd out for a sec. Bitcoin’s weekly chart shows a bullish hammer candle and a cup-and-handle pattern, screaming “upward rally” to analysts. FXEmpire notes Bitcoin bounced from $75,000 support to $85,000, eyeing $105,000 next. Gold’s chart isn’t slacking either, with an inverted head-and-shoulders pattern signaling more gains past $3,050.

The Bitcoin-to-gold ratio, a fave among traders, tells a story too. It’s dipped from 41 but holds a cup-and-handle formation, hinting at Bitcoin strength. If it hits support at 20, it’s buy-o’clock for Bitcoin bulls. These patterns aren’t just squiggles—they’re why analysts see Bitcoin chasing gold’s glitter to $155,000.

Bitcoin as a Hedge: Gold’s Cool Cousin

Macro Mayhem Protection

Bitcoin’s not just gold’s flashy sibling—it’s a hedge against macro madness. Think tariff trade wars, inflation spikes, or currency devaluation. When the U.S. slapped 104% tariffs on China in 2025, Bitcoin wobbled but held at $97,000, while gold climbed 6%. Why? Investors see both as safe havens when fiat currencies—like the yuan or dollar—get shaky.

Fidelity Digital Assets nails it: Bitcoin’s a macro asset, sensitive to big-picture trends like rising global money supply or inflation expectations. Unlike stocks tied to company earnings, Bitcoin’s value doesn’t hinge on micro factors. During the Russo-Ukrainian War, Bitcoin and gold both flexed their hedging muscle, with wavelet analysis showing Bitcoin shining in short-term risk reduction. So, when the world’s on fire, Bitcoin’s your digital bunker.

Micro Market Shield

But what about smaller storms, like a tech stock crash or a crypto exchange hiccup? Bitcoin’s got your back here too. When DeepSeek rattled OpenAI’s market share in January 2025, tech stocks tanked, and Bitcoin dipped 6%. Yet, it stabilized at $97,000, while tokenized gold and real-world assets (RWAs) surged 6.6%. This shows Bitcoin’s resilience in micro downturns, especially as investors pivot to blockchain-based safe havens.

Here’s a personal tidbit: I once panic-sold a stock during a market dip, only to watch Bitcoin hold steady. Lesson learned—Bitcoin’s volatility can be a feature, not a bug. It’s like a surfer riding market waves, not drowning in them. Studies back this up: Bitcoin’s low correlation with stocks makes it a diversifier, hedging micro risks better than gold in short-term G7 market swings.

FAQs

Q: Why do analysts compare Bitcoin to gold?

A: Bitcoin and gold share a limited supply, dodge central bank control, and act as safe havens during economic chaos. Their price charts often move in sync, like in 2020 and 2025.

Q: How could Bitcoin reach $155,000?

A: Analysts see Bitcoin following gold’s bullish patterns, fueled by ETF inflows, rising M2 money supply, and technical breakouts like the cup-and-handle.

Q: Is Bitcoin a better hedge than gold?

A: It depends. Bitcoin shines in short-term market dips, while gold’s steadier for long-term stability. Both hedge macro risks like inflation.

Q: Can Bitcoin protect against micro market risks?

A: Yup! Bitcoin’s low correlation with stocks makes it a diversifier, holding steady during tech sell-offs or crypto wobbles.

Q: Should I invest in Bitcoin or gold?

A: Both have perks. Bitcoin offers high upside but volatility; gold’s stable but slower. Consider your risk tolerance and mix ‘em for balance.

So, there you have it—Bitcoin’s strutting alongside gold, eyeing $155,000 while hedging against everything from trade wars to market hiccups. It’s like the cool cousin who shows up with flair but still has your back. I learned my lesson after that Thanksgiving word-fumble: keep it simple, and Bitcoin’s story sells itself. Ready to ride this digital gold rush?