Table of Contents

- How Stablecoins Work

- Types of Stablecoins

- Why Stablecoins Are Important

- Popular Stablecoins in 2024

- The Future of Stablecoins

- Final Thoughts

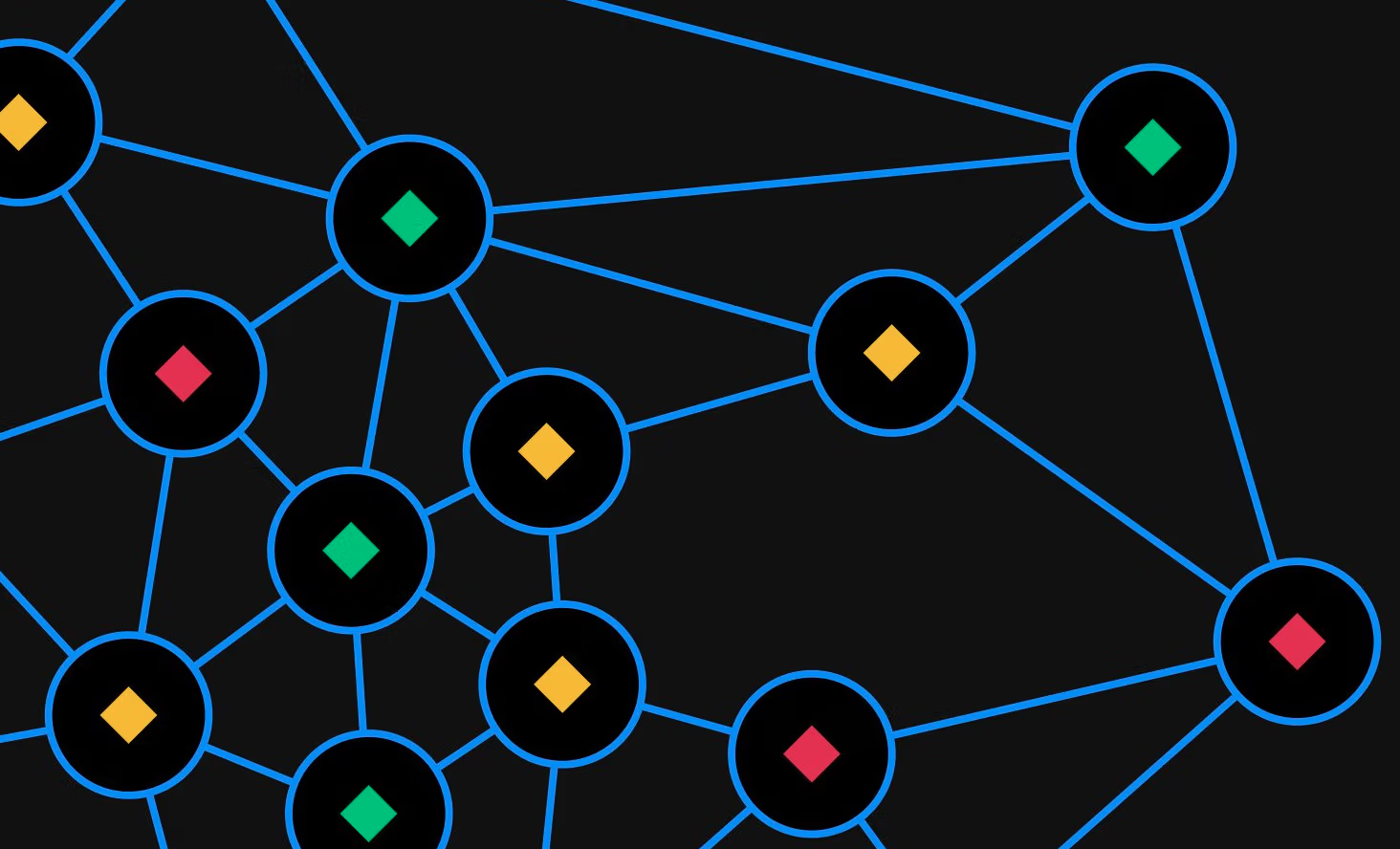

Imagine you’re in the world of cryptocurrency, where prices can swing wildly in minutes. Now, picture a calm island in that storm – a digital currency that stays stable, pegged to real-world assets like the U.S. dollar or gold. That’s what is a stablecoin!

Stablecoins are designed to bridge the gap between volatile cryptocurrencies like Bitcoin and the stability of traditional currencies. They combine the best of both worlds, making them incredibly useful for transactions, investments and cross-border payments.

Stablecoins achieve their stability by being linked to reserve assets. For instance:

- Fiat-backed stablecoins are tied to physical currencies like the dollar.

- Crypto-collateralized stablecoins rely on over-collateralization of other cryptocurrencies.

- Algorithmic stablecoins use complex algorithms and smart contracts to manage supply and demand.

These mechanisms ensure that stablecoins maintain a value close to their pegged asset, making them predictable and reliable in an otherwise unpredictable market.

Advertisement

Join Gemini today and get $15 in free Bitcoin when you trade with an easy, secure and U.S.-regulated crypto exchange you can trust. Offer valid for U.S. residents only; crypto investments are risky.

Types of Stablecoins

Fiat-backed Stablecoins

These are the most common type, backed by real-world assets like USD, EUR, or GBP. Examples include:

- USDC (USD Coin): Backed by U.S. Treasury securities and cash equivalents.

- Tether (USDT): Another heavyweight in the market, though its reserve transparency has been questioned in the past.

Crypto-collateralized Stablecoins

This type uses other cryptocurrencies as collateral, often over-collateralizing to account for crypto’s volatility.

- Example: DAI, governed by the MakerDAO system, is pegged to the U.S. dollar but backed by ETH and other assets.

Algorithmic Stablecoins

Here, stability is maintained by algorithms that automatically adjust supply based on demand. While innovative, these are also the riskiest, as seen in the downfall of TerraUSD (UST).

Why Stablecoins Are Important

Stablecoins have revolutionized the way we use cryptocurrency:

- Borderless transactions: Send money across the globe quickly without traditional banking fees.

- Hedging volatility: Protect investments from crypto market swings.

- DeFi (Decentralized Finance): Enable lending, borrowing, and earning interest in decentralized platforms.

- Stable store of value: Particularly useful for individuals in countries with unstable currencies.

Popular Stablecoins in 2024

In 2024, the stablecoin ecosystem is thriving with several key players:

- USDC: Known for its transparency and regulatory compliance.

- USDT: Remains the most widely used, despite controversies.

- Binance USD (BUSD): Backed by Binance, a leading crypto exchange.

Other noteworthy mentions include DAI, which offers decentralized stability, and newer entrants focusing on green energy initiatives.

The Future of Stablecoins

As regulations evolve, stablecoins are set to play a pivotal role in the global economy. Central banks worldwide are exploring Central Bank Digital Currencies (CBDCs), a concept inspired by stablecoins. Moreover, interoperability between blockchain networks and greater adoption in traditional finance are likely trends.

Final Thoughts

Stablecoins are more than just a “crypto safe haven.” They’re catalysts for innovation, powering DeFi, enabling borderless finance, and providing stability in a volatile market. Whether you’re a seasoned trader or a crypto newcomer, understanding stablecoins is crucial as they shape the future of finance.

So, the next time you hear someone ask, “What is a stablecoin?”—you’ll not only know the answer but understand why they’re the backbone of the crypto economy.