Table of Contents

- What Is Blockchain?

- How Does Blockchain Work?

- The Future of Blockchain Technology

- Real-World Examples of Blockchain

- Why Blockchain Matters in 2024

A Quick History of Blockchain

- The concept emerged in 1991 when researchers Stuart Haber and W. Scott Stornetta proposed a cryptographically secured chain of blocks.

- Fast forward to 2009, when Satoshi Nakamoto brought blockchain to life with Bitcoin, the first-ever cryptocurrency. Since then, blockchain has evolved beyond Bitcoin, sparking innovation across countless sectors.

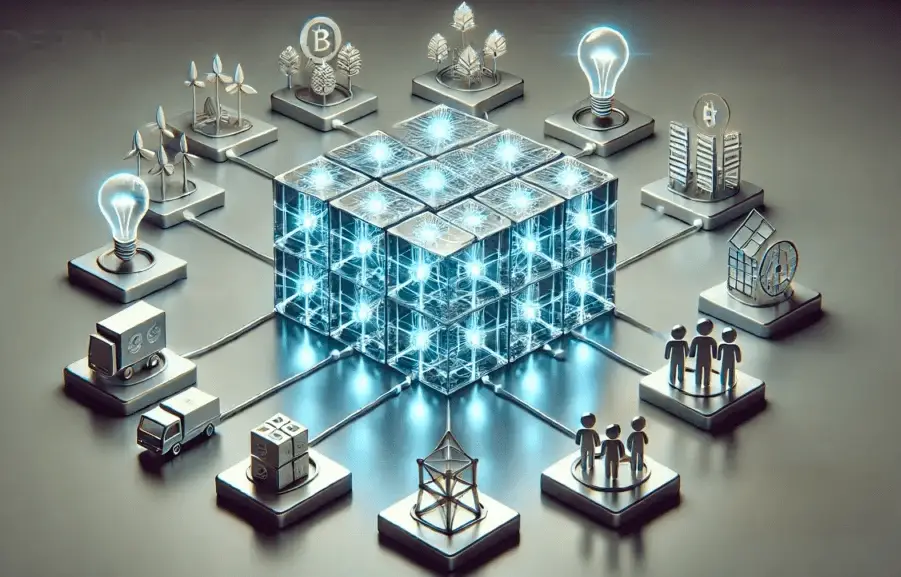

At its core, blockchain is a digital ledger—a decentralized, distributed database that records transactions in a secure, transparent, and tamper-proof way. Unlike traditional databases that rely on a central authority (think banks or governments), blockchain operates across a network of computers, ensuring no single entity has absolute control.

Picture a chain of blocks. Each block contains data—like transaction details, timestamps, and cryptographic hashes—that is locked in place. These blocks are linked chronologically, creating a secure, unchangeable history.

How Does Blockchain Work?

Blockchain technology may sound complex, but here’s a bite-sized breakdown:

1. Decentralization

In a blockchain, data isn’t stored on a single server. Instead, it’s distributed across thousands—or even millions—of computers (called nodes) worldwide. This decentralization means no single point of failure and a much harder time for hackers to break in.

Advertisement

Join Gemini today and get $15 in free Bitcoin when you trade with an easy, secure and U.S.-regulated crypto exchange you can trust. Offer valid for U.S. residents only; crypto investments are risky.

2. Transparency

Every transaction is visible to participants in the network. While users remain anonymous (thanks to cryptographic keys), the system’s transparency ensures accountability.

3. Immutability

Once data is recorded on a blockchain, it’s virtually impossible to alter it. This tamper-proof quality is achieved through cryptographic hashing and consensus mechanisms (more on these soon).

Key Components of Blockchain

- Blocks: These hold batches of transactions.

- Chains: Blocks are connected in sequential order.

- Nodes: Computers in the blockchain network.

- Consensus Mechanisms: Algorithms (like Proof of Work or Proof of Stake) ensure all nodes agree on the validity of transactions.

Example in Action

Let’s say Alice sends 1 Bitcoin to Bob. This transaction is bundled with others into a block. Before the block joins the chain, the network must verify and approve it using the chosen consensus mechanism. Once added, the transaction becomes a permanent part of the blockchain—no take-backs!

The Future of Blockchain Technology

If you thought blockchain was just about Bitcoin, think again! Its future is dazzling, and here’s why:

1. Beyond Crypto

While cryptocurrencies were blockchain’s first application, the technology is reshaping industries like:

- Healthcare: Ensuring secure patient records.

- Supply Chain: Improving transparency and traceability for goods.

- Gaming: Empowering players with in-game asset ownership through NFTs.

2. Scalability and Green Tech

Blockchain’s biggest challenge has been scalability (handling a high number of transactions efficiently). New solutions like Layer 2 protocols and sharding are tackling this head-on. Meanwhile, eco-friendly blockchains like Solana are addressing energy concerns, making blockchain greener.

3. Decentralized Finance (DeFi)

DeFi is removing middlemen from financial services like loans, insurance, and savings. Expect even more user-friendly platforms in 2024, offering global financial access like never before.

4. Governments Embracing Blockchain

Even skeptics are warming up! Governments are exploring blockchain for secure voting, public records, and even central bank digital currencies (CBDCs). Imagine filing taxes or registering a property with just a few clicks—no paperwork required!

Real-World Examples of Blockchain

Let’s spotlight some fascinating real-world use cases where blockchain is making waves:

1. Bitcoin (BTC)

The OG cryptocurrency, Bitcoin, remains the poster child of blockchain. With its decentralized ledger and secure network, Bitcoin has cemented itself as “digital gold.”

2. Ethereum (ETH)

Ethereum revolutionized blockchain with its smart contracts—self-executing agreements coded directly into the blockchain. Think automated payments or decentralized apps (dApps).

3. VeChain (VET)

Used in the supply chain industry, VeChain helps companies track goods from production to delivery. Ever wondered if your designer bag is authentic? Blockchain ensures it is!

4. Chainlink (LINK)

The Chainlink blockchain enables secure data transfer between smart contracts and external systems, like weather APIs for crop insurance or real-time sports data for betting platforms.

5. Puerto Rico’s Blockchain Island Initiative

Even governments are jumping on board. Puerto Rico, for instance, is positioning itself as a global blockchain hub, attracting startups and innovators with blockchain-friendly policies.

Why Blockchain Matters in 2024

In 2024, blockchain is no longer an emerging trend—it’s an unstoppable force. Here’s why you should care:

- Security First: In an age of cyberattacks, blockchain provides unparalleled data protection.

- Financial Inclusion: With over 1.4 billion unbanked adults globally, blockchain-powered DeFi offers hope.

- New Business Models: From decentralized autonomous organizations (DAOs) to tokenized economies, blockchain is rewriting the rules of engagement.

Conclusion

Blockchain isn’t just a buzzword; it’s a transformative technology reshaping our world. From powering cryptocurrencies like Bitcoin and Ethereum to revolutionizing industries like healthcare, supply chain, and finance, its potential knows no bounds.

Whether you’re a crypto enthusiast or a blockchain newbie, one thing is clear: this technology is here to stay—and its best days are still ahead.