Table of Contents

- What is the Gemini Mastercard?

- How Does the Gemini Mastercard Work?

- Crypto Cashback Categories & Percentages

- Key Features of the Gemini Mastercard

- How to Apply for the Gemini Mastercard

- Is the Gemini Mastercard Worth It?

- FAQs About the Gemini Mastercard

- Final Thoughts

Are you ready to turn your everyday shopping into a earn crypto on every purchase opportunity? The Gemini Mastercard makes it possible. Imagine buying groceries, gas, or dinner and instantly earning Bitcoin, Ethereum, or over 60 other cryptocurrencies. No more points that lose value or cash back that sits idle — with the Gemini Mastercard, you’re building a digital asset portfolio as you spend.

This guide will walk you through everything you need to know about the Gemini Mastercard, from how it works to how you can maximize your crypto shopping earnings. By the end, you’ll feel confident enough to sign up and start earning cryptocurrency on every swipe.

What is the Gemini Mastercard?

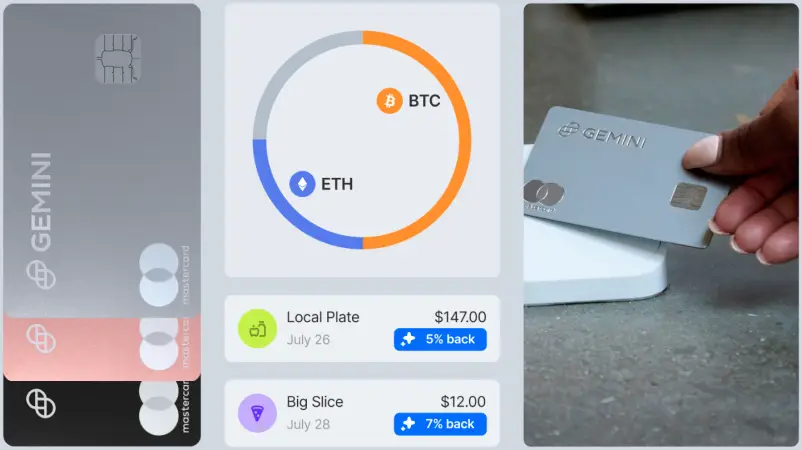

The Gemini Mastercard is a credit card that allows you to earn cryptocurrency rewards every time you make a purchase. Instead of earning traditional cashback or points, you earn crypto directly into your Gemini account.

Issued by WebBank, the Gemini Mastercard is linked to the Gemini crypto exchange, making it easy to convert, trade, or HODL (hold) your rewards. It’s a sleek, metal card that stands out from traditional plastic cards — both in looks and in earning potential.

Advertisement

Join Gemini today and get $15 in free Bitcoin when you trade with an easy, secure and U.S.-regulated crypto exchange you can trust. Offer valid for U.S. residents only; crypto investments are risky.

How Does the Gemini Mastercard Work?

Using the Gemini Mastercard is as simple as any other credit card. Here’s a step-by-step breakdown:

- Make a Purchase — Swipe, tap, or use your card online.

- Earn Crypto — Instantly earn rewards in your chosen cryptocurrency.

- Receive Your Rewards — Your crypto is deposited into your Gemini account with no waiting period.

Unlike other cashback cards, you don’t have to redeem or claim your rewards. They’re automatically added to your Gemini balance, ready to trade, sell, or HODL.

Crypto Cashback Categories & Percentages

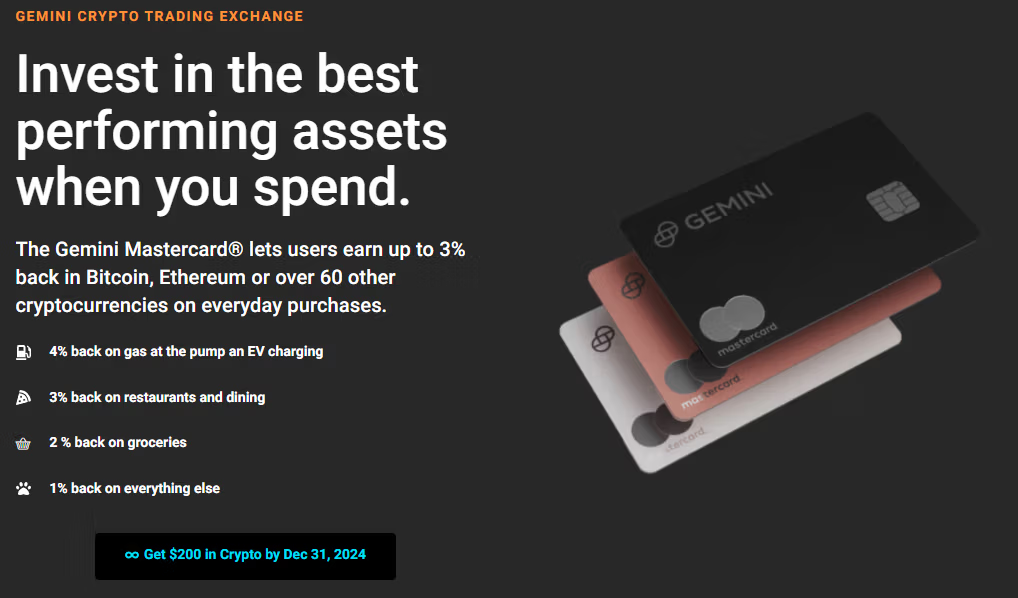

With the Gemini Mastercard, you can earn up to 4% back in crypto on your purchases. Here’s the full breakdown of cashback categories and earning rates.

1. Gas & EV Charging (4% Back in Crypto)

Fuel your car or power up your EV and earn 4% back in crypto. This category covers:

- Gas stations

- EV charging stations (like Tesla Superchargers or ChargePoint)

With gas prices fluctuating and EVs becoming more popular, this 4% cashback is a standout feature, especially for commuters or frequent travelers.

2. Restaurants and Dining (3% Back in Crypto)

Going out to eat? Earn 3% back in crypto on all dining purchases. This category includes:

- Restaurants (both fine dining and casual)

- Cafes and coffee shops

- Fast food chains

- Bars and lounges

If you’re someone who enjoys dining out, this category can seriously stack up your crypto earnings.

3. Groceries (2% Back in Crypto)

For your everyday grocery needs, you’ll earn 2% back in crypto. This applies to:

- Supermarkets

- Local grocery stores

- Online grocery delivery services like Instacart

Grocery spending is a major part of most people’s monthly budgets, so being able to earn crypto on these purchases is a big win.

4. Everything Else (1% Back in Crypto)

For all other purchases that don’t fall into the gas, dining, or grocery categories, you’ll earn 1% back in crypto. This covers:

- Online shopping (like Amazon)

- Subscription services (like Netflix, Spotify, etc.)

- Utility bills

- Travel expenses (hotels, flights, etc.)

This “catch-all” category ensures you’re always earning crypto, no matter where you shop!

Key Features of the Gemini Mastercard

The Gemini Mastercard comes with a handful of perks that set it apart from traditional cashback cards. Here’s what makes it special:

- No Annual Fee — Unlike many premium credit cards, the Gemini Mastercard has zero annual fees.

- Choose Your Crypto — Earn Bitcoin, Ethereum, or over 60 other crypto assets. You can even change your choice at any time.

- Instant Crypto Rewards — No waiting for statement credits — your crypto rewards are instantly available in your Gemini account.

- Metal Card Design — A sleek, eye-catching design that feels as premium as it looks.

These features make it a top choice for both crypto enthusiasts and everyday shoppers looking for something different.

How to Apply for the Gemini Mastercard

Applying for the Gemini Mastercard is simple. Here’s a step-by-step guide:

- Sign Up for a Gemini Account — If you don’t already have one, you’ll need to create a Gemini account.

- Apply for the Card — Navigate to the Gemini Mastercard page and hit “Apply.”

- Submit Your Information — Fill out the form with your personal details, including income and credit history.

- Wait for Approval — Approval decisions are often instant, but in some cases, you may have to wait a few days.

Once approved, you’ll receive your card in the mail. You can start using the digital version of your card right away.

Is the Gemini Mastercard Worth It?

The Gemini Mastercard is ideal for anyone interested in crypto or looking for a fresh spin on traditional credit card rewards. Here’s a quick checklist to see if it’s right for you:

- You believe in crypto’s long-term growth.

- You want a simple, fee-free rewards system.

- You want more than just cashback — you want crypto.

If you’re still on the fence, ask yourself this: Would you rather earn cashback that sits in a bank or crypto that could grow in value?

FAQs About the Gemini Mastercard

1. What credit score do I need to qualify for the Gemini Mastercard?

A good credit score (typically 670 or higher) increases your chances of approval, but it’s possible to qualify with a slightly lower score.

2. How do I choose which crypto I want to earn?

You can choose your preferred crypto from the Gemini app. You’re free to switch at any time.

3. Are there any fees with the Gemini Mastercard?

There are no annual fees, no foreign transaction fees, and no hidden charges.

4. Can I change my crypto rewards selection later?

Yes! If you start with Bitcoin but later prefer Ethereum, you can switch directly in the Gemini app.

5. What happens if I return an item I bought with the card?

Your crypto rewards for that purchase will be deducted from your account.

Final Thoughts

The Gemini Mastercard is a game-changer for people who want to blend shopping with crypto investing. With instant crypto rewards, flexible earning categories, and no annual fees, it’s one of the most unique credit cards on the market today.

So, what are you waiting for? Whether you’re a seasoned crypto enthusiast or a newcomer looking for a fresh rewards system, the Gemini Mastercard offers something special. Every purchase could be a step toward your financial future.

Take action today — and start earning crypto on your everyday spending!