📚 Table of Contents

- 🔍 What is a BRC-20 Token?

- ⚙️ How Do BRC-20 Tokens Relate to Bitcoin?

- 🎨 Why Are People Interested in Bitcoin NFTs?

- 💹 Current Bitcoin Price & Market Sentiment

- 🚀 The Future of BTC-20 Tokens: Opportunity or Risk?

- 📈 Final Thoughts: Is BRC-20 Here to Stay?

🔍 What is a BRC-20 Token?

BRC-20 is a new type of token standard for Bitcoin, similar to how ERC-20 tokens operate on Ethereum. While Bitcoin wasn’t originally designed to support “tokens” beyond BTC itself, the introduction of Bitcoin Ordinals and the Taproot upgrade enabled Bitcoin’s blockchain to store extra metadata. This development laid the groundwork for BRC-20 tokens, allowing fungible tokens to exist on the Bitcoin network.

Unlike ERC-20 tokens, which use smart contracts, BRC-20 relies on inscriptions via the Ordinals protocol. These inscriptions attach data to individual Satoshis (tiny Bitcoin units), essentially turning them into unique, trackable assets.

🧩 Key Features of BRC-20

- Fungibility: Unlike NFTs, BRC-20 tokens are interchangeable.

- No Smart Contracts: BRC-20 doesn’t rely on smart contracts like ERC-20; instead, it uses Ordinals inscriptions.

- Simple JSON Format: Token data is stored in a plain text file (JSON) rather than in a contract.

- Limited Tools & Support: Since it’s a new development, the tools for creating and managing BRC-20 tokens are still evolving.

Example: A well-known BRC-20 token is ORDI, which was one of the first BRC-20 tokens to capture the attention of the crypto community.

⚙️ How Do BRC-20 Tokens Relate to Bitcoin?

BRC-20 tokens exist on top of Bitcoin but do not change Bitcoin’s core protocol. Instead, they make use of the Taproot upgrade and the Ordinals system to attach data to Satoshis. Think of it as a “note” being stuck to a Bitcoin.

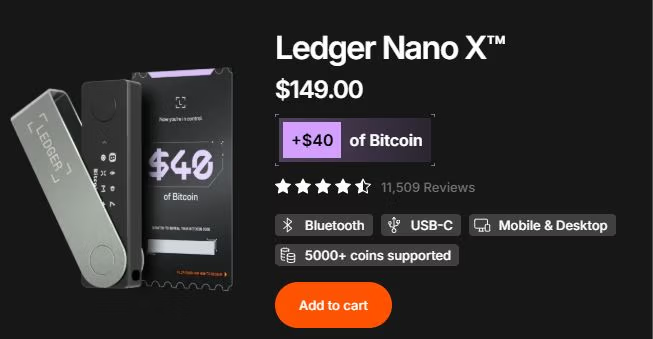

Advertisement

Join Gemini today and get $15 in free Bitcoin when you trade with an easy, secure and U.S.-regulated crypto exchange you can trust. Offer valid for U.S. residents only; crypto investments are risky.

This is different from Layer-2 solutions like the Lightning Network, which speeds up Bitcoin transactions. Instead, BRC-20s use the base Bitcoin blockchain, meaning block space demand increases, sometimes raising fees.

💥 How Do BRC-20 Tokens Impact Bitcoin?

- Higher Transaction Fees: BRC-20 activity increases the demand for block space, raising fees.

- Mining Revenue: Bitcoin miners benefit from higher fees as more people create and trade BRC-20 tokens.

- Increased Bitcoin Utility: By enabling tokens on Bitcoin, it widens Bitcoin’s role from “digital gold” to a more versatile blockchain.

🎨 Why Are People Interested in Bitcoin NFTs?

Bitcoin NFTs are digital collectibles stored on the Bitcoin blockchain using Ordinal inscriptions. Unlike Ethereum NFTs, which live on smart contracts, Bitcoin NFTs are directly inscribed on Satoshis.

Here’s why Bitcoin NFTs are trending:

- Scarcity: Only 21 million Bitcoin will ever exist, and Ordinals allow for even scarcer digital collectibles.

- Bitcoin’s Prestige: Ethereum has always been the “NFT blockchain,” but Bitcoin now has a seat at the table.

- Permanent Storage: Ethereum NFTs can be removed if off-chain storage fails, but Bitcoin inscriptions are on-chain forever.

Fun Fact: People have inscribed everything from artwork to music and even entire webpages on Bitcoin as Ordinals.

💹 Current Bitcoin Price & Market Sentiment

The price of Bitcoin fluctuates daily, driven by market sentiment, macroeconomic events, and institutional adoption. BRC-20 and Ordinals activity can also affect Bitcoin’s price.

📉 Current Bitcoin Price

To provide a current price, I would typically check the latest data from exchanges like Gemini or Coinbase. But at the time of writing, Bitcoin is trading at $100,000 with a market cap of $1.991 trillion.

🛠️ What’s Affecting Bitcoin’s Price?

- BRC-20 Hype: If demand for BRC-20 tokens increases, miners earn more fees, which can incentivize mining activity.

- Institutional Demand: As institutions like MicroStrategy and BlackRock buy more Bitcoin, supply diminishes, pushing prices higher.

- Global Events: Economic uncertainty (like inflation) often drives investors toward “digital gold” like Bitcoin.

🚀 The Future of BTC-20 Tokens: Opportunity or Risk?

The future of BTC-20 tokens is up for debate. Some see them as a game-changer for Bitcoin’s utility, while others argue they could cause congestion and higher fees.

🟢 Why BRC-20 Could Succeed

- New Revenue for Miners: Higher fees mean Bitcoin mining stays profitable even as block rewards diminish.

- Enhanced Use Cases: With tokenization on Bitcoin, DeFi projects could one day launch on BTC.

- First-Mover Advantage: Projects like ORDI have already gained traction, and others will follow.

🔴 Why BRC-20 Could Fail

- Congestion: Just like CryptoKitties clogged Ethereum, BRC-20s could jam Bitcoin’s network.

- No Smart Contracts: Without smart contracts, BRC-20 lacks some of the flexibility of ERC-20 tokens.

- Speculation-Driven: The hype could fade if people see BRC-20 as just another “cash grab” in the crypto world.

📈 Final Thoughts: Is BRC-20 Here to Stay?

While Ethereum is known for tokens and NFTs, Bitcoin’s evolution with BRC-20 and Ordinals has captured the attention of both investors and developers. Bitcoin is no longer just “digital gold”—it’s a playground for innovation.

Here’s the key takeaway:

If BRC-20 tokens continue to gain traction, we could see more utility for Bitcoin than ever before. While fees might rise, Bitcoin miners stand to benefit, ensuring network security stays strong. And with more eyes on BTC, its price could get a healthy boost as well.

Investor’s Note: If you’re a Bitcoin holder, this is an exciting development. Whether you see it as a positive change or an unwelcome distraction, one thing is clear—Bitcoin is evolving.

🚀 Want to Stay Ahead of the Curve?

If you found this guide helpful, check out our other articles on Bitcoin, BRC-20, and the latest developments in the world of crypto and NFTs. Don’t get left behind—stay ahead of the trends!