Imagine you’re at a bustling crypto party, and Ether’s the guest everyone’s talking about. Last week, crypto fund inflows hit a whopping $286 million, the strongest run in months, and Ether was the star of the show. Meanwhile, Bitcoin, the usual headliner, took a rare backseat with $8 million in outflows. So, what’s the deal? Let’s unpack why crypto fund inflows are making waves and how Ether leads investments with an epic rise.

Key Takeaways

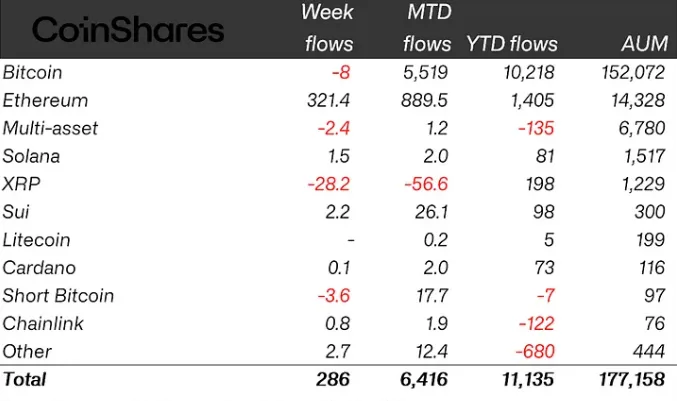

- Crypto fund inflows reached $286 million last week, with Ether leading investment trends.

- Ethereum ETFs, especially BlackRock’s, drove massive inflows, totaling over $287M in two weeks.

- Bitcoin saw $8M in outflows, signaling a shift in investor focus to Ether.

- The Ethereum Pectra upgrade and easing trade war fears boosted market optimism.

- Institutional interest in Ether is growing, hinting at a bullish future for 2025.

Table of Contents

- Key Takeaways

- Why Crypto Fund Inflows Matter

- Ethereum’s Moment in the Spotlight

- Bitcoin’s Brief Stumble: What’s Going On?

- What’s Driving the Market?

- FAQs About Crypto Fund Inflows and Ether’s Surge

- Final Thoughts: Ether’s Time to Shine

Why Crypto Fund Inflows Matter

Crypto fund inflows are like the pulse of the market—they show where smart money’s headed. When investors pour cash into exchange-traded products (ETPs) like Ethereum or Bitcoin ETFs, it’s a sign of confidence. Last week’s $286 million haul tells us big players are betting on crypto’s future, and Ether’s leading the pack. Why? It’s not just hype. Institutional giants are diving in, and global events are shifting the mood. Plus, Ether’s recent price surge—up over 40% in a month—has folks buzzing about its potential to hit $3,000 or more.

Ether Leads Investment with a Bang

Now, let’s talk numbers. Ether exchange-traded funds (ETFs) raked in over $286 million last week, with BlackRock’s Ethereum fund grabbing the lion’s share. On one day alone, it pulled in millions, making up a huge chunk of the day’s inflows. By the end of the week, Ether funds marked multiple days without outflows. It’s like Ether’s on a winning streak at the crypto casino, and investors can’t get enough. Compare that to Bitcoin’s $8 million dip, and it’s clear: Ether leads investment right now, and the momentum’s building.

Ethereum’s Moment in the Spotlight

Imagine Ethereum as the underdog finally getting its Oscar moment. While Bitcoin’s been the crypto king, Ether’s been quietly stacking wins. Last week, it outshone Bitcoin ETPs, pulling in $286 million while Bitcoin funds bled $8 million. So, what’s fueling this glow-up? Two words: institutional interest and market momentum.

Advertisement

Join Gemini today and get $15 in free Bitcoin when you trade with an easy, secure and U.S.-regulated crypto exchange you can trust. Offer valid for U.S. residents only; crypto investments are risky.

BlackRock’s Ethereum ETF: The Game-Changer

BlackRock’s Ethereum fund is like the cool new kid everyone wants to hang with. Since launching, it’s amassed billions in inflows, with millions pouring in on a single day last week. Why the frenzy? BlackRock’s a heavyweight in traditional finance, and their crypto moves signal Wall Street’s warming up to digital assets. They’re even pushing to allow staking in ETH ETFs, which could supercharge yields. If approved, it’s like giving Ether a turbo boost. For now, the fund’s dominance in crypto fund inflows shows Ether’s not just a sidekick anymore.

Why Ether Outshines Bitcoin Right Now

Bitcoin’s the big dog, but Ether’s got the edge for a few reasons. First, Ethereum’s blockchain powers decentralized apps (dApps) and smart contracts, making it the backbone of Web3. Bitcoin’s more like digital gold—valuable, but less versatile. Second, Ether’s recent price action is turning heads. It climbed significantly in a month, while Bitcoin dipped slightly. Finally, the Pectra upgrade is hyping up investors, promising faster transactions and better scalability. It’s like Ether’s getting a shiny new engine while Bitcoin’s still cruising in neutral.

Bitcoin’s Brief Stumble: What’s Going On?

Now, don’t count Bitcoin out just yet. Its $8 million in outflows last week is a hiccup, not a knockout. One day saw Bitcoin ETFs lose hundreds of millions, ending a multi-day inflow streak. BlackRock’s Bitcoin fund was the only one in the green, but even that couldn’t stop the slide. Why the dip? Some point to profit-taking after Bitcoin’s recent rally to record highs. Others say investors are rotating into Ether for its growth potential. Either way, Bitcoin’s still a titan, holding massive assets. It’s like a heavyweight boxer taking a breather before the next round.

What’s Driving the Market?

Crypto markets are like a rollercoaster—thrilling, unpredictable, and sometimes nauseating. So, what’s pushing crypto fund inflows and Ether’s surge? A mix of global events, tech upgrades, and investor vibes are steering the ride.

Global Events and Investor Sentiment

Last week, easing trade tensions gave markets a breather. This was a green light for risk assets like crypto. Ether ETFs saw multiple days of inflows totaling hundreds of millions, as investors felt the heat of opportunity. Meanwhile, Bitcoin’s outflows might reflect caution after its massive rally earlier this year. It’s like investors are reshuffling their decks, betting big on Ether’s momentum.

The Pectra Upgrade Buzz

Then there’s Ethereum’s Pectra upgrade, the talk of the town. Set to roll out soon, it promises lower fees and faster transactions—music to investors’ ears. The upgrade’s timing aligns with Ether’s ETF inflows, as institutions bet on Ethereum’s long-term potential. It’s like giving Ether a new pair of wings just as the market’s ready to soar.

FAQs About Crypto Fund Inflows and Ether’s Surge

1. What are crypto fund inflows?

Crypto fund inflows measure money pouring into crypto investment products like ETFs or ETPs. They signal investor confidence and market trends. Last week, $286 million flowed into crypto funds, with Ether leading investment.

2. Why is Ether leading investment over Bitcoin?

Ether’s outpacing Bitcoin due to strong ETF inflows, the Pectra upgrade hype, and Ethereum’s versatile blockchain. Investors see more growth potential in Ether right now.

3. Are Bitcoin’s outflows a bad sign?

Not necessarily. Bitcoin’s $8 million outflow is small compared to its massive market cap. It could reflect profit-taking or a shift to Ether, not a lack of faith.

4. How does the Pectra upgrade impact Ether?

The Pectra upgrade will make Ethereum faster and cheaper, boosting its appeal for dApps and investors. It’s a big reason Ether leads investment trends.

5. Should I invest in Ether ETFs now?

It depends on your goals and risk tolerance. Ether’s momentum is strong, but crypto’s volatile. Do your research and consider consulting a financial advisor.

Final Thoughts: Ether’s Time to Shine

Crypto fund inflows are painting a clear picture: Ether’s having a moment. With $286 million flowing into crypto funds and Ether leading investment, it’s like Ethereum’s finally stepping out of Bitcoin’s shadow. The Pectra upgrade, BlackRock’s ETF push, and a brighter global outlook are fueling the fire. Sure, Bitcoin’s still the king, but Ether’s the scrappy contender stealing hearts—and dollars. So, whether you’re a crypto newbie or a seasoned hodler, keep an eye on Ether. It’s not just a coin; it’s a movement. Ready to join the party?