Ever feel like crypto has mood swings worse than your ex? One minute it’s all-time highs, the next it’s nose-diving like a rollercoaster with no brakes. That’s not randomness—it’s what we call crypto market cycles. These cycles are the rhythm of the crypto world, shifting between four main market phases: accumulation, uptrend, distribution, and downtrend. If you’re wondering why everyone suddenly turns into a financial guru during bull runs and ghosts during bear markets, you’re about to find out. Understanding these patterns isn’t just smart—it’s your survival guide in the wild west of crypto.

Key Takeaways

- Crypto market cycles follow four key phases: accumulation, uptrend, distribution and downtrend.

- Recognizing market phases improves your entry and exit timing.

- Each phase reflects investor sentiment and real-world market activity.

- Understanding cycles is essential for making smarter moves in 2025’s altseason.

Table of Contents

- Key Takeaways

- What Are Crypto Market Cycles?

- Why Do Market Phases Matter in 2025?

- The 4 Main Phases of Crypto Market Cycles

- How Do Emotions Drive Market Cycles?

- Signs You’re in Each Market Phase

- Case Study: Bitcoin 2020–2025

- What Altseason 2025 Tells Us

- This X Post Nails It

- Crypto Market Cycles vs Stock Market Cycles

- Common Questions Answered

- How This Helps You

- Final Thoughts

- FAQs

What Are Crypto Market Cycles?

Crypto market cycles are the heartbeat of the digital asset world. Like seasons, they come and go—rising, peaking, falling, and stabilizing in a loop that can feel like financial déjà vu. At their core, these cycles are patterns in price behavior, driven by investor psychology, supply-demand dynamics, and broader economic trends.

The four main market phases—accumulation, uptrend, distribution, and downtrend—are not just theory. They’re the framework seasoned traders use to spot opportunities and avoid traps. In 2025, with crypto adoption skyrocketing, understanding these cycles isn’t optional. It’s survival.

Why Do Crypto Market Cycle Phases Matter in 2025?

Because timing is everything! In 2025, we’re seeing stronger institutional adoption, tighter regulation, and more nuanced investor behavior. You don’t want to be the one buying when the whales are selling. Recognizing each market phase can help you catch the wave before it crests—or at least avoid getting wiped out.

Advertisement

Join Gemini today and trade $100 or more to get $75 in your favorite crypto! Trade Bitcoin, Ethereum and Altcoins with a secure, U.S. regulated crypto exchange you can trust. Offer valid for U.S. residents only, crypto investments are risky.

Just last week, @CryptoKaleo posted,

“If you still think we’re in accumulation, look at ETH/BTC—market’s screaming altseason.”

Truth is, cycles are easier to ride when you know what phase you’re in.

The 4 Main Phases of Crypto Market Cycles

Accumulation Phase: The Calm Before the Storm

This is when prices are flat, headlines are boring, and crypto Twitter is quieter than a library on Friday night. But beneath the surface? Smart money is buying. Think of it like real estate after a crash—nobody’s talking, but deals are being made.

It’s also when I first bought Bitcoin back in 2018. Everyone said I was crazy. “Didn’t that thing crash?” they’d ask. Fast forward two years—I was sipping coffee in Bali, portfolio up 5x.

Uptrend Phase: The Rocket Launch

This is the party phase. Prices soar, TikToks go viral, and your cousin who thought crypto was a scam last year is suddenly a ‘trading expert.’ Volume spikes. FOMO kicks in. Newbies rush in, pushing prices even higher.

But remember: trees don’t grow to the sky. The uptrend doesn’t last forever.

Distribution Phase: Smart Money Sells

Prices plateau. Volatility increases. It’s the financial equivalent of musical chairs—someone’s going to lose, and smart money is already quietly heading for the exit.

Did You Know?: The distribution phase in crypto market cycles is when asset prices peak and begin to stabilize. It’s typically marked by increased volatility, lower volume, and strategic selling by institutional investors.

Downtrend Phase: When the Bears Take Over

The mood shifts. Fear replaces greed. Headlines scream “Crypto is dead!” as prices fall off a cliff. This is when emotional traders capitulate—selling low after buying high.

But guess what? For those with a long-term lens, it’s another chance to prepare for the next accumulation phase. Rinse, repeat.

How Do Emotions Drive Crypto Market Cycles?

Imagine the market as a mood ring. Each phase reflects collective psychology—hope, euphoria, anxiety, despair. You can’t trade emotions, but you can use them as a compass. Ever bought a coin just because it was trending? Yeah, that’s FOMO talking.

Tip: Watch for sentiment shifts on X and Reddit—when everyone’s euphoric, it might be time to trim.

Signs You’re in Each Crypto Market Cycle Phase

- Accumulation: Flat prices, low volume, quiet chatter

- Uptrend: Exploding prices, new ATHs, FOMO everywhere

- Distribution: Sideways movement, increasing volatility

- Downtrend: Capitulation, negative news, low morale

Case Study: Bitcoin 2020–2025

Bitcoin perfectly illustrated these phases. After the March 2020 COVID crash (accumulation), BTC surged to $69K in 2021 (uptrend), hovered in a choppy range into 2022 (distribution), and dipped below $20K in 2022–23 (downtrend). Now in 2025? Many analysts say we’re mid-accumulation again—especially with ETF adoption and macro tailwinds.

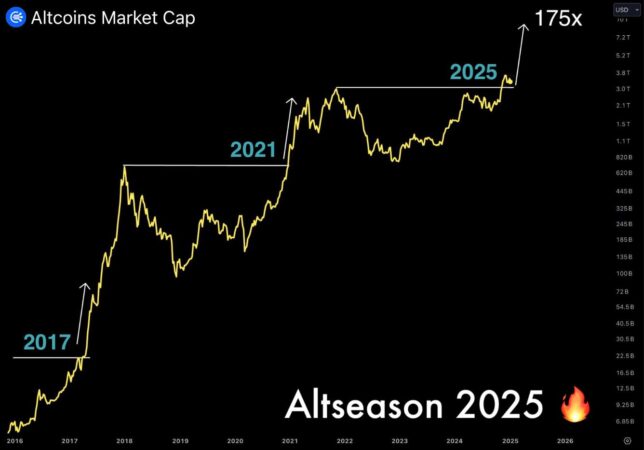

What Altseason 2025 Tells Us

This year’s altseason has been a trip. While Bitcoin hovers, altcoins like SOL and AVAX are mooning. What gives? It signals we’re exiting accumulation and tiptoeing into early uptrend territory. The dominoes are falling—just look at weekly volume.

Messari’s Q2 2025 report calls this a “rotational bull setup.” Basically, alts are the opening act before Bitcoin headlines the stage again.

This X Post Nails It

“2025 feels like 2020 but on steroids. Altcoins are moving before BTC. Narratives are faster. Retail’s not back yet, but smart money is. Watch the patterns.” – @AltcoinAlpha2025

Crypto Market Cycles vs Stock Market Cycles

Stock market cycles move like a cruise ship—slow, deliberate, often reactive to earnings and interest rates. Crypto? It’s a speedboat. You blink, and it’s changed direction. While both follow similar macro principles, crypto’s youth and volatility make its cycles more extreme—and more frequent.

Common Questions Answered

What triggers each phase?

Macro news, regulatory changes, institutional activity, and good ol’ human psychology. Even memes can play a part (hello, Dogecoin!).

How long does each cycle last?

There’s no one-size-fits-all. Some cycles last months, others years. Bitcoin’s 4-year halving cycle often sets the tone, but altcoins can dance to their own beat.

Can you profit in a downtrend?

Absolutely. Shorting, staking, and dollar-cost averaging into promising projects are all smart strategies during bear phases. Plus, building conviction when prices are low often pays off big later.

How Crypto Market Cycles Help You

If you’re here, you’re probably wondering when to buy, sell, or just HODL. By understanding crypto market cycles, you gain a compass—not a crystal ball, but a solid guide. Recognizing market phases can help you avoid emotional decisions, reduce risk, and spot real opportunities in a chaotic sea of noise. Whether you’re a first-timer or a grizzled DeFi veteran, this knowledge turns volatility from foe to friend.

Final Thoughts

Crypto market cycles aren’t just charts and numbers—they’re stories of greed, fear, hope, and strategy. Learn them, respect them, and use them. Because whether it’s 2025 or 2035, the cycles will keep spinning. The question is: will you ride them, or get rolled by them?

FAQs

- Is it too late to buy crypto in 2025?

Not necessarily. If we’re mid-accumulation, now could be a strategic entry point. - What’s the safest way to navigate crypto market cycles?

Stick to fundamentals, dollar-cost average, and don’t chase pumps. - How do I know when a cycle is ending?

Watch volume, sentiment shifts, and institutional behavior. No single indicator is foolproof. - Are altcoins affected by the same crypto market cycles?

Yes, but they often lag or lead Bitcoin, creating mini-cycles within the broader trend. - Should I sell everything before a downtrend?

Depends on your strategy. Many prefer to rotate into stablecoins or hedge rather than exit entirely. - Where can I buy altcoins and Bitcoin safely and securely?

The top U.S. regulated crypto exchanges are Coinbase and Gemini.