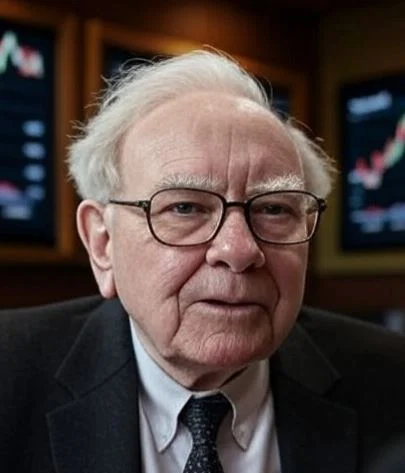

So I am chilling at the water cooler in the break room and try to impress a co-worker with some fancy investing lingo. I toss out “diversification” like I’m Warren Buffett himself, only to trip over the word and mumble something about “diversifying my coffee order.” Cue the awkward laugh. Thankfully, the real Warren Buffett doesn’t fumble. The Oracle of Omaha just made headlines by exiting his crypto-friendly Nubank holdings for a cool $250 million profit, while also pulling out of Citigroup and trimming Bank of America stakes, offloading over $2.1 billion in financial stocks. So, grab your latte, and let’s chat about what Warren Buffett’s up to—it’s a masterclass in investing with a side of sass.

Table of Contents

- Key Takeaways

- Why Warren Buffett Bailed on Nubank

- The Big Financial Sector Pullback

- What’s Behind Warren Buffett’s Moves?

- Lessons from Warren Buffett’s Playbook

- FAQs

Key Takeaways

- Warren Buffett sold his entire Nubank stake, earning $250 million profit.

- He exited Citigroup and cut Bank of America holdings, shedding $2.1 billion in financial stocks.

- Buffett’s moves suggest a cautious retreat from the financial sector, possibly due to crypto exposure or economic uncertainty.

- His cash reserves hit a record $347.8 billion, signaling a “wait and see” strategy.

- Investors can learn from Buffett’s discipline: stick to what you understand and don’t chase trends.

Why Warren Buffett Bailed on Nubank

So, why did Warren Buffett, the guy who buys businesses like I buy snacks at a gas station, ditch Nubank? Let’s break it down. Nubank, a Brazil-based fintech darling, has been killing it with record profits lately. It’s got over 100 million customers and a sleek app that lets you trade Bitcoin, Ethereum, and even XRP. Sounds like a Buffett dream, right? Not so fast.

Nubank’s Crypto Flirtation

Nubank’s been cozying up to crypto, adding Cardano, Near Protocol, and Cosmos to its platform recently. This is a big deal in Latin America, where digital banking is booming. But here’s the kicker: Warren Buffett isn’t exactly crypto’s biggest fan. He once called Bitcoin “rat poison squared.” Ouch. So, when Nubank went all-in on crypto, it might’ve raised a red flag for Buffett.

Buffett’s Crypto Skepticism

Now, don’t get me wrong—Buffett’s not anti-tech. He’s got a massive Apple stake, after all. But crypto? That’s a hard pass. He once said he wouldn’t buy all the Bitcoin in the world for $25 because he doesn’t know what he’d do with it. Nubank’s crypto push probably clashed with Warren Buffett’s “stick to what you know” Kiernan.

Advertisement

Join Gemini today and get $15 in free Bitcoin when you trade with an easy, secure and U.S.-regulated crypto exchange you can trust. Offer valid for U.S. residents only; crypto investments are risky.

The Big Financial Sector Pullback

Okay, Nubank’s exit is juicy, but it’s just one piece of the puzzle. Warren Buffett’s been playing financial sector Tetris, and he’s clearing blocks left and right. Recently, Berkshire Hathaway sold off Citigroup entirely and slashed its Bank of America stake, unloading over $2.1 billion in financial stocks. Let’s dive into these moves.

Ditching Citigroup

Citigroup was a relatively new bet for Buffett, starting a few years back. But recently, Berkshire was out, selling a position worth over $1 billion. Why? Citigroup’s been wrestling with regulatory headaches and a messy restructuring. Plus, it’s trading at a discount to its book value, which sounds like Buffett’s jam, but maybe not when the bank’s stuck in a rut.

Slicing Bank of America

Then there’s Bank of America, Buffett’s long-time love. Berkshire still holds a hefty $29 billion stake, but Warren Buffett sold 34% of it since mid-2024. Bank of America’s still a giant, but Buffett’s trimming suggests he’s not as smitten as he used to be.

What’s Behind Warren Buffett’s Moves?

Alright, let’s put on our detective hats. Why’s Warren Buffett, the guy who buys and holds like I cling to my favorite sweatshirt, selling like there’s a fire sale? Here are a few theories.

First, there’s the crypto angle. Nubank’s crypto embrace might’ve spooked Buffett, who’s famously allergic to assets he can’t value. But it’s not just Nubank—his broader financial sector retreat hints at bigger concerns. Some speculate he’s bracing for economic turbulence. After all, banks are sitting on unrealized losses, and stagflation could spark a crisis.

Second, Buffett’s cash pile is massive. Berkshire’s reserves hit $347.8 billion, with $305.5 billion in short-term Treasurys. That’s like me hoarding snacks for a Netflix binge, except Buffett’s prepping for opportunities—or trouble. He’s been selling more than buying for a while, which screams caution.

Third, it could be strategic profit-taking. Buffett’s known for locking in gains when valuations get frothy. Nubank’s stock soared recently, outpacing Apple and Tesla. Selling high? Classic Buffett.

Here’s a personal tidbit: I once tried to “time the market” with a hot tech stock, only to sell right before it doubled. Lesson learned—stick to Buffett’s long-game mindset. His moves aren’t knee-jerk; they’re calculated, like a chess grandmaster plotting ten moves ahead.

Lessons from Warren Buffett’s Playbook

So, what can we mere mortals learn from Warren Buffett’s latest saga? Plenty. Here’s the good stuff, served with a side of humor.

- Know Your Circle of Competence: Buffett avoids crypto because he doesn’t get it. I avoid karaoke for the same reason—stick to your strengths.

- Don’t Chase Hype: Nubank’s crypto pivot is trendy, but Buffett’s not here for fads. He’s like my grandma, who still uses a flip phone and loves it.

- Cash Is King: That $347.8 billion war chest? It’s Buffett’s safety net. Having cash gives you options, like when I saved up for a rainy day and splurged on concert tickets.

- Be Patient: Buffett’s been investing since forever (kidding, but he’s 94!). His patience pays off, unlike my impulse buys at the grocery store.

- Take Profits Wisely: Selling Nubank at a peak? Smart. It’s like selling your old couch before it falls apart.

FAQs

Q: Why did Warren Buffett sell his Nubank stake?

A: Warren Buffett likely sold due to Nubank’s crypto focus, which clashes with his skepticism about cryptocurrencies. His broader financial sector pullback also suggests caution.

Q: How much profit did Buffett make on Nubank?

A: Buffett’s Berkshire Hathaway netted $250 million by selling its entire Nubank stake recently.

Q: What other financial stocks did Buffett sell?

A: Warren Buffett exited Citigroup (worth over $1 billion) and cut Bank of America by 34%, part of a $2.1 billion financial stock sell-off.

Q: Is Buffett bearish on banks?

A: Not necessarily, but his sales signal caution. Banks face unrealized losses and economic risks, and Buffett’s building cash reserves.

Q: What’s Buffett doing with all that cash?

A: With $347.8 billion in reserves, Warren Buffett’s likely waiting for undervalued opportunities or preparing for market volatility.

So, there you have it—Warren Buffett’s latest financial plot twist, served with a sprinkle of humor and a dash of real talk. His Nubank exit, Citigroup dump, and Bank of America trim show he’s playing defense, stacking cash like a squirrel before winter. Whether it’s crypto jitters or economic foresight, Buffett’s moves remind us to stay sharp, stick to our knitting, and maybe not try to sound smart at the coffee shop. What do you think—would you follow Buffett’s lead or dive into crypto?